We would like to introduce you to good anti-phishing and anti-check fraud information websites, so you don't fall victim to Internet phishing or fake check scammers.

Important Notice: Phishing & Spoofing

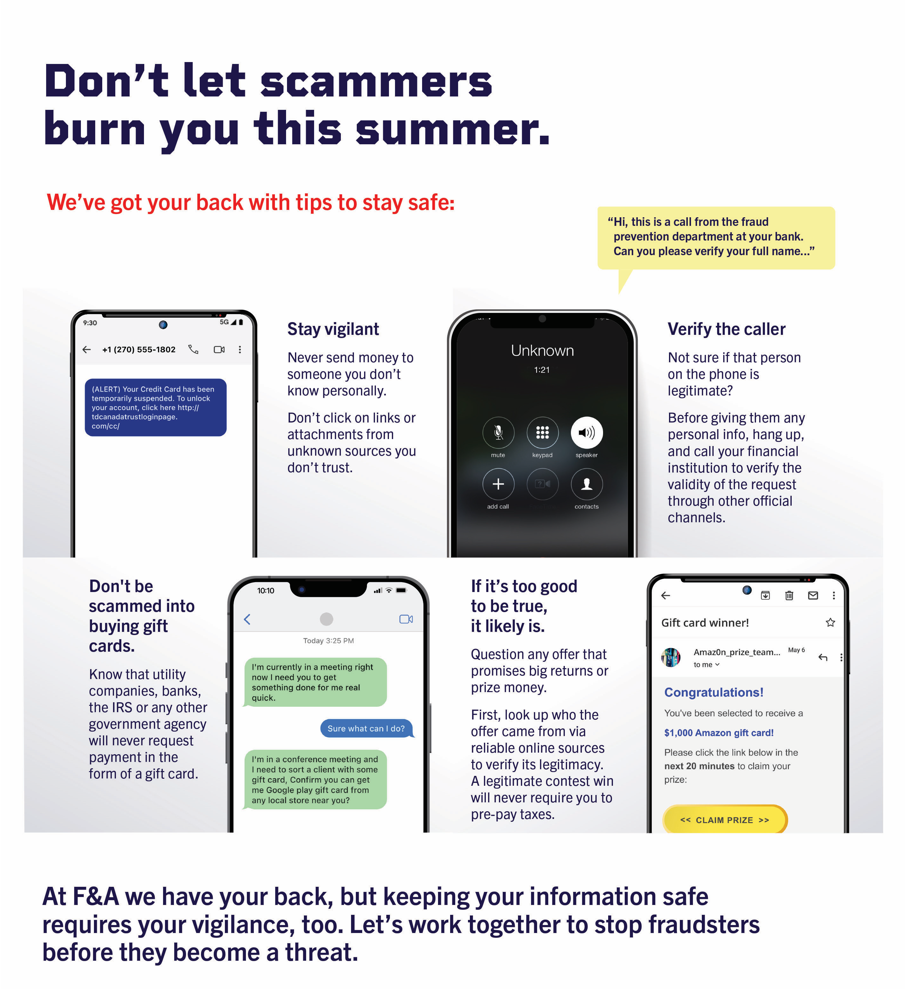

With the recent rise in email and internet scams (phishing and spoofing scams), it is extremely important to never disclose any of your personal or account information over the phone or online, unless you have verified the authenticity of the individual or website.

F&A Federal Credit Union assures you that we will never initiate calls or send emails to our members asking for personal member information, such as Social Security Number, address, credit card numbers, etc. F&A routinely asks for verification of members contacting the credit union. This is just one of the security measures taken when conducting business transactions. If you have questions or concerns regarding identity theft, please feel free to contact the credit union.

Protect Yourself from Identity Theft

It is estimated that 9.9 million Americans were victims of identity theft in 2004. Identity theft is the fastest growing crime in America, according to a Federal Trade Commission survey!

Don't become identity theft's next victim

There are simple precautions that will keep your identity safe. We've provided the following information as a courtesy to help protect you from identity fraud and other criminal activities.

Review the links and information on this page to learn how to protect your personal and financial information.

If your identity has been stolen, here's what to do:

- Call F&A Federal Credit Union at 800-222-1226 for immediate assistance.

- Contact the fraud departments of any one of the three major credit bureaus to place a fraud alert on your credit file. The fraud alert requests creditors to contact you before opening any new accounts or making any changes to your existing accounts. As soon as the credit bureau confirms your fraud alert, the other two credit bureaus will be automatically notified to place fraud alerts, and all three credit reports will be sent to you at no cost.

- Credit Bureaus: Experian, Equifax and TransUnion.

- Close the accounts that you know or believe have been tampered with or opened fraudulently.

- Use the FTC's ID Theft Affidavit when disputing new unauthorized accounts.

- File a police report. Get a copy of the report to submit to your creditors and others that may require proof of the crime.

- File your complaint with the FTC. The FTC maintains a database of identity theft cases used by law enforcement agencies for investigations. Filing a complaint also helps us learn more about identity theft and the problems victims are having so that we can better assist you.

- If you believe you have been a victim of mail fraud, submit a mail fraud complaint form with the U.S. Postal Inspection Service.

Be Smart. Protect Yourself from Identity Theft

The following information is designed to safeguard your financial information.

Credit card fraud generally occurs when cards or card numbers are compromised. By following these simple guidelines your potential for loss can be minimized.

Tips for protecting yourself against credit card fraud

- Keep a list of all your credit cards including the account number and phone number to the issuing company.

- Review your credit card statement as soon as possible. Match charges with your receipts to ensure all charges are yours and are for the correct amount.

- Always sign a new credit card immediately.

- When making a purchase with a credit card, make sure your get back the card and the receipt. Check the receipt for accuracy.

- When using a credit card at a restaurant or store, make sure that all blank lines are marked through so that no one can change the final amount.

- Never sign blank credit card receipts.

- Only travel with the credit cards you plan on using.

- Never give the account number of the credit card over the phone unless you initiate the call.

- When making an order over the telephone, try to avoid using a cordless phone. Cordless phones messages can be easily intercepted by devices as unsophisticated as baby monitors and police scanners.

- Do not write the PIN for the account on the card.

You can also use Card Lock to lock your F&A credit or debit cards and prevent unauthorized transactions. It's a free service from F&A.

Identity theft can occur when an individual obtains personal information, such as your social security number, date of birth, address, and financial account numbers. Once this information is obtained, the thieves will assume or take on your identity, allowing them to illegally purchase items or obtain credit. By following these simple guidelines, your potential for loss due to identity theft can be greatly reduced.

Tips for protecting yourself against identity theft

- Check your credit report on a regular basis to ensure the information is correct.

- Immediately tear up (using a shredder is even better!) unsolicited credit card offers.

- Never give personal information over the phone unless you initiated the phone call.

- Never give a credit card number over the phone unless you have initiated the phone call.

- Always be familiar with financial accounts that you currently maintain. Verify statements and other information sent by your financial institution for accuracy.

- If you must store your canceled checks cut a triangle out of the signature line thereby eliminating duplication of the check and signature.

This guide provides tips for protecting yourself against check cashing fraud. Check cashing fraud occurs when individuals use information taken from your checks, or the checks themselves, to access your accounts and commit fraudulent acts. By following these simple guidelines you can greatly reduce your risk of becoming a victim.

Tips for protecting yourself against check cashing fraud

- Always safeguard your checks. Do not leave your checks out in an open area. Never leave your checks in your car or out on your desk at the office.

- Keep your blank checks and canceled checks in a safe place. Put them in a vault or other secure location. Destroy old blank checks if you are not going to use them.

- Limit the amount of personal information printed on the checks to your name and address. Use plain designed checks. The fancier the check the easier it is to forge the signature. Useful information for thieves includes not only your account numbers, but information used to verify your identity, such as your driver's license number, social security number, and secret codes. Don't have this information printed on your checks.

- Don't leave your bill payments sitting in an unlocked mailbox for pickup. Many credit thieves will steal bills from rural mailboxes at the end of driveways so they can get your account information, checking information, and even your checks. Go to the Post Office directly or use a curbside USPS mailbox (the blue metal ones) and drop your bills in the slot rather than using less secure street mailboxes.

- Be discreet when writing checks in public places. Write your checks carefully and leave no space in which figures or words can be inserted.

- When you make an error in writing a check, be sure to destroy the check or write "canceled" across it and store it with your other canceled checks.

- If your checks are lost or stolen, report it immediately to your financial institution.

- Reconcile your monthly statements as soon as you can to ensure all transactions are accurate. Contact us immediately if you do not receive it when expected. Be sure to contact your institution within that time frame to ensure that proper attention is given to reconciling the problem.

- When you reorder checks, mark your calendar. If you don't receive your checks within 15 working days, contact your financial institution immediately to inquire as to the status of the order.

- Consider alternatives to check writing. For instance, paying by phone, online, or setting up automatic payments. Fewer checks mean fewer theft opportunities.

Consumers Should Be Vigilant and Avoid Depositing Checks from Unknown Parties

ALEXANDRIA, Va. (April 10, 2017) - Consumers should be on the lookout for fake check scams, the National Credit Union Administration warned today after receiving numerous inquiries from consumers.

There are many versions of a fake check scam. However, the result is the same. Scammers lure consumers into depositing a cashier's check, money order, or other checking instrument from someone that they don't know and wiring or sending money to the scammers. A check may take considerably longer to clear the financial institution that issued it before the funds can be collected. It could take days or even weeks to discover that the deposited check was fraudulent.

When the check is discovered to be fraudulent, the damage may already have been done. Once a victim wires or sends funds from such a check, he or she may be responsible for reimbursing the financial institution for that amount. Typically, the financial institution will not cover the financial loss and expects the victim to pay the difference.

The Federal Trade Commission also recently issued a fake check scam alert. These checks can be hard to recognize. They may be printed with the names, addresses, and logos of legitimate financial institutions. Consumers are reminded to be on the alert and to not be pressured into wiring funds or sending money after depositing a check.

If you think you or someone you know was the victim of a fake check scam, consider taking the following steps:

- Contact your local law enforcement agency to report the scam.

- Contact your state's attorney general. Contact information for each state's attorney general can be found on the National Association of Attorneys General website.

- File a complaint with the Federal Trade Commission. Your complaint will be filed into a secure online database, which is used by many local, state, federal, and international law enforcement agencies. Complaints from consumers help detect patterns of fraud and abuse.

- If you or the victim is an older adult or a person with a disability, contact your local adult protective services agency. You can find local support resources using the online Eldercare Locator or by calling 1-800-677-1116.

NCUA operates an online Fraud Prevention Center that offers information about avoiding frauds and scams on its MyCreditUnion.gov website. NCUA also released a two-part video series for consumers on fraud prevention techniques.

Under the Federal Credit Union Act, promoting financial literacy is a core credit union mission. While credit unions serve the needs of their members and promote financial literacy within the communities they serve, NCUA works to reinforce credit union efforts, raise consumer awareness and increase access to credit union services. NCUA also participates in national financial literacy initiatives, including the Financial Literacy and Education Commission, an interagency group created by Congress to improve the nation's financial literacy and education. Access NCUA's Financial Literacy Resource center at NCUA.gov for more information.

ATM fraud can occur when individuals lose their card, give their card to someone else to use, or when their Personal Identification Number's confidentiality is compromised. By following these simple guidelines you can greatly reduce your exposure to ATM fraud.

Tips for protecting yourself against ATM fraud

- Never write your Personal Identification Number (PIN) on your card or in your wallet. Memorize your PIN as soon as possible. Do not reveal your PIN to anyone not authorized to use the account.

- Never use your date of birth, social security number, license number or street address as a PIN -- those are the first numbers a crook will try.

- Don't throw away your ATM receipts at the ATM location. Keep them to reconcile your account, then dispose of them properly when you get home.

- Always be aware of your surroundings when using the ATM. If it is late at night, try to use a machine that is well lit and avoid dark, remote locations.

- Always make sure to retrieve your ATM card from the machine when the transaction is complete.

- Be aware of the person behind you. Make sure no one can see you entering your PIN or how much money you withdraw.

- Review your statement promptly to ensure all transactions are accurate. Report any discrepancies immediately.

- Destroy old ATM cards immediately after receiving your replacement cards.

In addition to the types ATM fraud that most of us are now aware of, there are two new types that can clean out your account quickly -- card withholding and skimming.

Card withholding occurs when your card gets stuck in the ATM, you can't get it out, and you leave the card in the ATM planning to contact the financial institution the next morning. When you call you find that the card was not stuck in the ATM. What happens is that thieves put a substance into the ATM card slot which will cause your card to stick inside the ATM. They leave the ATM and wait for someone to attempt to use the it. They then get in line behind the you and try to watch you enter your Personal Identification Number (PIN). This is very common at drive-up ATMs where the user may not be paying attention to other people or cars nearby.

The thieves even go so far as to put up a sign on the ATM stating: "If your card gets stuck, enter your PIN three separate times to retrieve it." This gives them three tries to watch you enter your PIN. After you leave frustrated, and planning to contact the ATM owner the next morning, they remove your card with a pair pliers. They can then use your card at other ATMs and Point-of-Sale (POS) terminals.

Skimming is done at businesses that offer Point-of-Sale (POS) devices for you to pay with your ATM card, such as gas stations. The thieves convince an employee to allow them to connect a lap top computer or other device to the POS machine. The lap top is usually stored under the counter where the POS device is located. When you swipe your card in the POs device to make a payment the information on the magnetic strip on your ATM card is copied and loaded onto a disk. Thieves may also install a hidden video camera that records you entering your PIN. They then match the magnetic information to the PIN and access your accounts. Be on the watch for anything that is out of the ordinary.

Precautions to take for countering these scams:

- Before inserting your ATM card into an ATM inspect the card slot for any residue.

- If there is residue, don't use that ATM. If there is a notice on the ATM about entering your PIN several times, don't use that ATM.

- Always cover your hand when entering your PIN: if the thieves don't have your PIN, they can't access your account.

“Congratulations, you're hired!” Tim said a week after receiving my online job application.

This was music to my ears after three months without a decent job offer. The best part was that I'd be paid to drive my car around town. All I had to do was let his company wrap my car with advertisements to start earning money right away. No passengers or deliveries required.

I'd read about companies using everyday drivers to act as mobile billboards, so I thought this would be a great way to supplement my income even after I secured a full-time job. But, right then, I needed money quick to pay bills. I was starting to receive past due notices and had already borrowed money from family.

“We are happy to have you on board,” Tim continued. “I'll go ahead and send you your first check in the mail. It should arrive in the next few days. Just deposit and take out $1,000 cash to pay the local specialist for the wrap installation.”

I thought that it was kind of strange that I'd have to pay for the wrap installation out of my check but was so excited to know that I'd have a check for $3,500 in the next few days - I didn't care. That still left me with $2,500.

A few days later, I was at home visiting with my friend Abby when the check arrived. I hadn't mentioned my new job to anyone yet, but now that I had the check, I felt more confident about what I was doing. I told her about my conversation with Tim and how relieved I was to be able to pay my bills.

After a few moments of running her fingers over the check like a detective, she raised an eyebrow as she held the check in her hand, “Seriously?”

“Yes.”

“Natalie, look at this check.” I looked at it. It was printed on copy paper. It had my new employer's name at the top. It even had the name of a national bank in the lower left corner. I didn't see what the big deal was. Abby pointed to the upper left corner. “There's no address here. Just the company's name.”

“So.” I squeaked.

“Don't you think that's kind of weird?” She reached for the United States Postal Service priority mail envelope that held the check a few moments earlier. I grabbed it before she had a chance to see what I saw. The return address was from a different company. Okay, I had to admit. That. Was. Odd.

When I looked up, Abby had already pulled out her phone and had the website of my new employer on her screen. My mouth went dry. According to the site, my new employer specialized in heating ventilation and air conditioning components not wrapping cars. I was sure that there had to be two companies with the same name. I had Abby search again. And again. And again.

I fell into my chair. This couldn't be right. There must be some mistake.

“Natalie? Hello, Natalie.” Abby waved her hands in front of my face. “Snap out of it. Do you have this guy's number?”

I pulled out my phone and called Tim.

“This is our normal procedure,” Tim repeated. He avoided my questions about the different company names. I pressed him about his company's location. He just kept urging me to deposit the check.

I didn't know what to believe. Tim finally said that he only wanted to deal with serious people and his installation specialist was waiting on the money. I hung up the phone. Abby touched my shoulder and assured me that I'd avoided a huge financial mess.

***************

Luckily, Natalie's friend Abby helped her dodge a version of the fake check scam. Tim was counting on Natalie to deposit a $3,500 check with the hopes of having his buddy, the “local specialist,” collect $1,000 cash. Scammers know that banks and credit unions must make funds available to you within two (2) business days of deposit.

Available funds is not the same as having a check that has cleared.

Fake checks can take weeks to be discovered. In the meantime, scammers like Tim and his partner in crime, leave Natalie liable for the $1,000 and any additional money withdrawn against the check.

Never deposit a check you receive from someone who wants you to give them cash back. Some scammers may try to convince their victims to wire the money instead of requesting cash.

If someone asks you to deposit a cashier's check, money order or personal check in order to receive a portion of those funds in return, this might be a version of a fake check scam. Here's what you should do instead:

- Do not deposit the check or money order.

- If the check was received via United States Mail, contact the United States Postal Inspection Service.

- File a consumer complaint with the Federal Trade Commission.

- Contact your local law enforcement and state's attorney general. Be prepared to provide them with a written account of everything that happened.

- Make copies of the documents you received from the scammer. Provide them to authorities.

- View NCUA Consumer Report: Frauds, Scams and Cyberthreats educational videos, which explain common fraud schemes and how to avoid them.

- Please share your story and the NCUA videos with family and friends to help protect them from potential scammers.

If you have already deposited a check or money order in your account, contact an F&A Federal Credit Union member representative as soon as possible to discuss steps to remedy the situation.

“I'll need remote access to your computer before I can help you.” Those are words I will never forget.

Three months ago, I was eager to talk to a live person who could resolve my issue. I thought I would be on hold for ages, but my call was picked up on the second ring. I told him why I was calling hoping my desperation wasn't obvious.

At first, I'd ignored the pop-up warnings on my laptop. Then the messages got scary. I wasn't sure if they were always so dire or if it was because I was finally taking the time to read them from beginning to end.

The most recent pop-up made me take notice. It was in a different color and warned me that I needed to take action now because my computer was infected with malware or some crazy virus.

“Tabitha, go to the web address I just gave you. We'll get everything taken care of,” said James, an IT professional from a well-known tech company.

I was relieved when I finally called the number in the pop-up and James answered. He reassured me that a new antivirus program would remove not only the annoying alerts, but protect the other personal data I had stored on my computer.

“Uh-huh, I can see it on our end. Yup, your computer is infected with a nasty virus. It's a good thing you called us when you did.”

I shared with James the reason I finally made the call. The last alert told me if I didn't call the phone number that my computer access would be disabled for my safety. Apparently, someone was trying to access my financial information, social media account logins, and credit card data. At least that's what James told me. He and his team needed to get my attention.

He even said how the same thing happened to him about six months ago, so he understood how I felt.

I clicked on the link at the website just like James had instructed.

“This is the only antivirus program we recommend to take care of issues like this.”

“How much is it?” I braced myself.

James cleared his throat. “$600.00.”

Silence.

“It comes with a lifetime warranty,” he added.

“Really? That's kinda expensive,” I muttered.

“It'll take care of all of those notices and keep you safe. Trust me. Look, if you don't take care of this now, it won't be good.”

I didn't know what to do.

“Tabitha, don't worry. I'm going to talk to you while I go ahead and install the program on your computer. Just click “allow access” and we can get started.”

I gave him my credit card number, remote access to my computer and waited while he downloaded a new program I'd never heard of.

As he talked about his wife and kids, I became more comfortable. He seemed like a normal guy. He used a lot of technical terms, so he sounded pretty knowledgeable. James even reassured me that when he was done I'd be able to browse online again without worrying someone was watching my every move.

The following week is when I noticed several of my financial accounts were off. My checking account had a payment to an online retailer that I'd never visited. My credit card had two new charges for spa services at luxury hotels in another city. I hadn't left my hometown in over two years. I called my credit union and credit card company. I didn't want to believe it. I didn't want to go there, but I couldn't shake the feeling.

James and “his family” were treating themselves at my expense.

***************

Tabitha contacted her credit card company to dispute the charges including the charge for the antivirus program. After speaking with the credit card company's fraud department, she learned that when she gave James access to her laptop, he likely installed a backdoor trojan that gave him and his band of bandits access to the entire contents of her laptop whenever they wanted. This included files that contained logins, passwords, and financial account information.

She couldn't figure out how he'd accessed her credit union account. Tabitha's account information wasn't stored on her computer. Her credit union informed her that James must have left another surprise. He'd installed a keylogger which tracked her keystrokes when she logged into her credit union account online.

You can avoid becoming a tech support scam victim by following these tips:

- Understand that well-known tech companies do not contact their customers with pop-up notices. They do not track nor make unsolicited attempts to resolve technology issues.

- Since these scammers also make phone calls to snare their victims, hang up and block their calls.

- Don't trust caller ID to confirm the caller's true identity. Caller ID can be masked or altered to display the name of a well-known tech company. Again, well-known tech companies do not make unsolicited attempts to repair your computer.

- Never share passwords with anyone who contacts you.

- Use a password manager to help safeguard multiple passwords. Otherwise, it might be overwhelming to keep track of them all. If you use the same login ID and password for every website, you've made the scammer's job much easier.

- Ignore or remove these annoying pop-ups yourself by following these instructions.

- View educational videos at Federal Trade Commission's Tech Support Scams. The website explains variations of this scam and how to avoid becoming a victim.

If you think you're a victim of the tech support scam, contact an F&A Federal Credit Union member representative as soon as possible to discuss steps to remedy the situation.

“Yes, that's right ma'am. Pet Society of America.”

“And, you do what again?” I said as I placed my bag of groceries on the counter.

“Well, we save dogs and cats. You know - cute pets. You've heard of us - I'm sure. We also go by PSA.”

The telemarketer caught me off guard. I'd answered the call as I walked into my apartment. I was expecting my sister Sarah, but instead, I got Jack from PSA.

“Sorry, I can't talk right now.”

“But, ma'am, your donation today can save lives!”

I switched the phone to my other ear. “I'm really not interested.” I was about to hang up.

“Wait! Ben needs you,” he said before I could disconnect the call.

“Ben? I don't know a Ben.”

Who was Ben? I knew a Ben back in college, but that was a long time ago. “What Ben - I mean Ben who?”

“Ben is an 8-month-old puppy. He was found outside in the cold.”

“What?” I whispered. I looked over at my dog Lucy who hadn't noticed that I'd made it home. She's a good dog - a chihuahua-terrier mix. Even though Lucy's puppy years are long behind her, I couldn't imagine leaving her or any other dog out in the cold to fend for herself. She was just a year old when I brought her home from the shelter.

“You can help puppies like Ben. Did I mention that he was chained to a tree when the rescuers found him?”

I swallowed hard and sat down.

“Ma'am. Are you there?”

“Yes, I'm here.” I couldn't believe what I was hearing.

“So, as I was saying. You can help Ben and his littermates…”

“Wait, he has brothers and sisters? They were found with him?” My eyes started to sting.

“Yeah - ya' know you sound like a really nice person. You don't want anything bad to happen to any more puppies. Your donation of $100 today can help save Ben and…”

“How does the money help puppies like Ben?”

“Well, uh, you know. We - um - I mean the rescuers have to pay for gas to locate the puppies and that type of stuff.”

I looked over at Lucy now playing with her chew toy. “How much is the minimum donation?”

“$100. The sooner we get the donation, the more lives we can save.”

He was right. I'd heard on the news about people neglecting animals. The money to help those fur babies had to come from somewhere.

“All we need you to do is overnight us some gift cards to help pay for gas. This would be a huge help since our rescuers travel all over and don't like to carry cash. We need you to do it today.”

“I don't know about that.”

“Each day you wait we lose other puppies like Ben.”

I couldn't swallow past the lump in my throat.

“Where do I send it?”

I scribbled the address on a notepad.

“So, you'll send the gift cards today, right?” he asked.

“Yes, I'll put them in the mail today.”

“Good,” he sighed. “Ben and his friends really appreciate it.”

“Do you have a website I can share? I have some coworkers who are animal lovers. I bet they'd want to help too.”

“Well, actually - yes, we do. It's PetSociety.com. But, I have to talk to your co-workers if they want to donate. We don't accept online donations. It helps keep costs down.”

“Okay. I'll be sure to share your information.”

When I went to show my co-workers the PetSociety.com website the following week, it didn't exist. I had a feeling that Ben and puppies like him would not be helped with my donation.

***************

Since the telemarketer convinced his victim to purchase gift cards and mail them to the scammers, it's unlikely that she'll get her money back since gift cards are nearly impossible to trace. By playing on her emotions and getting her to act quickly, they obtained the gift cards and disappeared.

You can avoid becoming a charity scam victim by following these tips:

- Confirm the legitimacy of a charitable organization at SmartAsset.com or Charity Navigator.

- Send your donation via traceable means, e.g., personal check or credit card. Do not make contributions using gift cards, cash, wire or ACH transfers since these methods make it hard to track down the scammers. Just because its traceable doesn't mean you will get your money back if it's a fraudulent charity. Do your homework and thoroughly research who you donate to.

- Stop communication if the caller pressures you to donate immediately.

- Even though websites may look professional, avoid charity websites that end in “.com.” Most reputable non-profit or not-for-profit charitable organizations have sites that end in “.org.”

- Skip entering credit card information on websites that are not secure. The donation page must have a URL that begins with “ https://” which indicates that the site is secure and data entered will be encrypted. If the “s” is missing, then the site is not secure.

- Delete unsolicited charity emails that contain attachments or hyperlinks. Fraudsters count on you to click on them which results in a virus being downloaded to your computer. Once downloaded, they can use the virus to access your personal information.

- Report the incident to the Federal Trade Commission and your state attorney general's office.

I was watching my favorite morning game show when I got the call.

“Bobby is in jail. He needs bail money - now,” the caller said.

My heart skipped a beat, and I turned off the television.

Bobby is my grandson. A sweet boy. He's my favorite among the bunch, but I'll never admit it. He's in college out of state. Bobby's going to be a doctor one day.

“My Bobby?” my voice went up an octave. “Who is this? Where are you calling from?”

“This is Jennifer with Weinstein, Mathews, and Crooks, um - Attorneys at Law. Your grandson was behaving badly last night, and he's in a bit of trouble. Drunk driving. Our law office can't help him unless we receive money for his legal expenses.”

I gripped the phone harder. “Oh, my. I'd better let his parents know. Hold on while I get a pen to write down your phone number.”

“We don't have time for his parents. This was the number he gave us, and he said you really love him so you'll help him. Besides, I don't think he wants his parents to know.” Jennifer made sense. Bobby had a speeding ticket earlier this year, and his parents were pretty hot about it.

“All we need is for you to send money today so we can get him out of jail,” Jennifer continued.

“Well, of course, I want to help Bobby but - “

“Okay - great! He needs $1,500. To make things easier, you can purchase $1,500 in Visa gift cards and FedEx them to our office. This is much safer than sending cash.”

I wrote down the address where I was to FedEx the money.

“Now, remember Bobby needs you to get that in the mail today because if we don't receive it in the morning, well, let's just say jail isn't a place for a nice kid like your grandson.”

My eyes stung. I quickly blinked as I read back the address Jennifer gave me.

Before we hung up, she told me that Bobby knew he could count on me.

I couldn't let him down. That afternoon I purchased the gift cards and dropped off the FedEx envelope.

Several days passed. I thought Bobby would have called to let me know he was okay. Sometimes grandkids can be absentminded, so I finally called him.

“Hi Nanna,” Bobby said after the third ring.

“Oh, Bobby. It's so good to hear your voice. Are you okay?”

“Yeah - things are going great at school! I'm getting ready for finals, so I've been pretty busy. I'm sorry I haven't called.”

“I understand. I mean, it's not as if you could actually call me if you wanted to.”

“What do you mean?”

I didn't want to embarrass him. “Well, you know.”

“Nanna - I don't know what you mean,” he said slowly.

I told Bobby about my call with Jennifer, about Weinstein, Mathews, and Crooks - Attorneys at Law, and about his drinking and getting behind the wheel. There was a long pause before he finally spoke.

“Nanna, I was never arrested. And, I've never heard of Weinstein, Mathews, and Crooks - Attorneys at Law.”

***************

Since Bobby's grandmother purchased gift cards and provided them to the scammers, this is not considered fraud and the money spent cannot be recovered. The scammers were relying on her to act quickly by making the situation appear desperate or otherwise indicating that the family member would be harmed if they don't take action immediately.

Family emergency scams aren't limited to claims that a family member needs money to get out of jail. Other ways scammers snare their victims is by claiming that the family member needs money:

- For a hospital bill

- To pay for an accident in which someone else was harmed

- In order to leave a foreign country

They may even pretend to be the loved one and when questioned about why they sound different, will often claim that they have a cold or have been drinking. Regardless of which tactic is used, scammers play on the victim's emotions to get them to take action right away.

You can avoid becoming a family emergency scam victim by following these tips:

- If you receive a phone call, text message or email requesting financial assistance, don't send money right away, regardless of how desperate the situation seems. This includes wired money, gift cards, checks or cash sent via overnight delivery.

- Ask questions that only someone close to your family member would know about your relationship. Remember, if the family member has a social media account, e.g., Facebook, Instagram, Twitter, etc. they may share things about themselves but are unlikely to share things that only the two of you would know.

- Call another family member to confirm the story even if you're pressured to keep quiet.

- Report the incident to the Federal Trade Commission and your attorney general's office.

If you think someone is trying to pull the family emergency scam, you can also contact an F&A Federal Credit Union member representative as soon as possible to discuss steps to remedy the situation.

It all started with a conversation between two longtime friends via SmileBook, a popular mobile messaging app…

SmileBook Conversation 1: The Setup

AUG 5, 9:45 AM

Sheila: "Hey, sweetie. U not gonna believe this.

Got my hands on a 40,000$ government grant."

Beatrice: "What? U kiddin?"

Sheila: "No, 4 real - EZ. I think you could get 1 - 2."

Beatrice: "I never qualify for anything.

Health is bad — money issues.

No help - nowhere."

Sheila: "Try it."

Beatrice: "K"

Sheila: "Contact Phil Swipper. He's the grant agent.

Just message him in SmileBook or call him.

888.555.1254. Do it today. : ) LMK"

Beatrice: "Okay. : )"

------------

SmileBook Conversation 2: The Catch

AUG 5, 10:27 AM

Beatrice: Are you 4 real? I qualify?!!!?

Phil (Grant Agent): Yes, ma'am. All you need to do is

pay the upfront fee of 600$ for processing

the grant and the money is yours.

Beatrice: Fee?

Phil (Grant Agent): Normal processing fee. Just go to the store and buy 600$ in gift cards and

you'll have the 40K in a few days.

Beatrice: I don't know.

Phil (Grant Agent): You want the fee grant money, don't you?

SmileBook Conversation 2: The Close

AUG 5, 1:49 PM

Beatrice: Okay, got the gift cards.

Where do I send them?

Phil (Grant Agent): No need to mail them since that'll delay processing. Just scratch off the code on the back and take a picture of the front and backside of the card. Send the pics to me.

Beatrice: Okay. Doing it now.

Phil (Grant Agent): Great! You'll have your money soon.

------------

The next day, Sheila and Beatrice run into each other at the local community center's aqua aerobics class.

Sheila: "I'm telling you, Beatrice, that SmileBook message didn't come from me."

Beatrice: "But, look at this, Sheila. That's you. That's your picture in SmileBook. You sent me the message."

Sheila: "Yes, but (Gulp)… I think someone hacked my account."

------------

A few minutes later…

SmileBook Conversation 4: Second Thoughts

AUG 6, 3:18 PM

Beatrice: I changed my mind.

Phil (Grant Agent): That's okay. We understand. The money will go to someone else. We have a long waitlist.

Beatrice: What about my gift cards?

Phil (Grant Agent): Since you don't have the money yet, no worries. Cards haven't been activated.

Beatrice: Sigh. Thank you!!!

Phil (Grant Agent): You bet. : )

------------

A half-hour later…

In-store Conversation 1: The Reveal

Beatrice: "Hi! I need to return these gift cards."

Store Clerk: "I'm sorry ma'am, you can't".

Beatrice: "Why not? I haven't used them. They haven't been activated."

Store Clerk: (Scans the cards.) "I'm sorry ma'am, but these cards have already been activated and spent."

------------

***************

While the private messaging scam can occur on any platform, it seems to be gaining momentum on Facebook, according to AARP. It starts when fraudsters replicate or hack a friend's messaging app profile. Once they have the profile set up, they will start sending messages to account connections that might include fake grant notifications or other requests for private financial data. Either way, the goal of the scam is to separate you from your money by exploiting your online friendships.

Protect yourself from private messaging scams by:

- If you receive a shocking or surprising message from an online friend, don't respond right away. Before clicking any links or sharing information, speak with your friend offline to confirm the message came from them.

- Be wary of simple messages like “Hi” or “Hey” without any follow up text. If this is not how your friend typically communicates or initiates conversation, proceed with caution. Scammers will attempt to engage using non-suspicious, but out of character communication.

- If you can't reach your friend offline right away, ask questions. Make sure the person you're messaging is really your friend and not a shady character. Ask questions only the real person could correctly answer, but don't stop there. Press the sender for more information about the grant or other offer being presented.

- Report the activity to the private messaging app company. This can help reduce further attempts to perpetrate a particular scheme.

- Deny friend requests from strangers.

- Update your privacy setting in the app. Read the app's Privacy Policy for details to determine the appropriate setting for you.

- Let your friend know that their account may have been compromised so they can take appropriate action.

I Won The Lottery - Now I Have to Pay?

Lottery Scam

My hands were shaking as I reread the letter from Ambird Sweepstakes Company:

This letter is to inform you that the Ambird International Lottery held it's $5 million drawing on 1st February 2019. Beth Johanson, attached to ticket number 541-664913 with serial number 343-231354641, drew the lucky numbers of 51-67-12-21-06-22 which consequently won the lottery in the 1st place category.

I enter a lot of sweepstakes, but I didn't remember entering this one. Who can keep track of them all? Just because I couldn't remember entering it, doesn't mean I didn't.

You are therefore a guaranteed winner of a lump sum payout of USD 5 million (five million United States dollars). There are no other winners in this category. CONGRATULATIONS!

O.M.G.!

Your funds are being held by the customs department at your local airport for pickup. Due to possible mix up of names and numbers, we ask that you keep this reward from public notice until processed for security and avoid double claiming.

Okay, even though the English and grammar were sketchy, I understood what they meant. They didn't want anyone else trying to claim my winnings, so I needed to keep things quiet at least for now. The letter went on to tell me how the ticket was selected using a computer ballot system. I skipped down to the information about how to claim my money.

To begin claim, contact our United States offices at (555) 190 - 0110. Remember, all lottery prize money must be claimed no later than the 7th of February 2019. This date all funds will be returned to Ambird International Lottery for the next drawing.

The letter was signed by the owner of Ambird International Lottery and had an official looking logo.

I knew I needed to act fast, but a week seemed like a tight turnaround. I immediately dialed the number and received a voicemail. I left a message, and someone called me back within a few hours.

“Your check is waiting for you at the airport, but it can't be released,” said David, the Ambird Customer Service Representative.

“Wh - Why?” My stomach tightened.

“Ms. Johanson, you have to pay taxes on your winnings before they can be released. It's standard practice.”

“Okay - how much?” I asked as I braced myself for the answer.

“Let's see. On $5 million United States Dollars, that'd be - $900,000.00.”

“WHAT?! I mean - oh, I'm sorry. I didn't expect it to be that much. I don't have that kind of money.”

David asked about my financial accounts. I told him I had accounts at more than one financial institution but was careful not to give him any more details.

“Ms. Johanson, you do understand that taxes have to be paid, don't you? Since you live in the United States, you'll have to pay federal, state and local taxes on your winnings. It's really a small amount to pay in comparison to what you'll be getting.”

I ended our call wondering how I would raise the money. David left me his number in case I changed my mind. I wanted to talk to friends and family about it, but David convinced me that if I did, one of them might try and claim the money for themselves. I'd dismissed any possibility of collecting my winnings until I received a letter from the IRS two days later.

Dear Ms. Johanson,

Congratulations! We understand that you are the sole winner in the Ambird International Lottery held on 1st February 2019. You will need to pay $900,000.00 in federal income taxes before you can claim these funds.

I wanted to cry. There had to be another way.

I dialed David's number, and he finally answered on the 8th ring.

“Why can't I just pay you after I receive the money?” I asked.

“It doesn't work that way, but we might be able to help you. Hold the line, please.”

After what felt like hours, David returned to the line. “We could use your help.”

“Me? You could use my help?”

“Yes, one of our investors needs help. I think before you mentioned that you had accounts at more than one credit union. All you have to do is accept a wire to your account at one credit union. When you receive those funds simply rewire those funds to your other credit union account. Then wire the funds to our investor and a few other people.”

“Huh?” I didn't understand, but I would do anything to get my hands on my money. I'd mentally spent my winnings before I'd even seen a dollar.

David repeated the instructions, and I took notes.

I couldn't keep the secret anymore. The next day, I shared the story with my friend Kerry who wasn't as excited about it as I was.

“Let's call the custom's office at the airport to see if they have the check,” she offered.

“Fine.”

She put the phone on speaker as we both listened to the agent tell us they do not hold checks in customs. After telling him he had to be wrong, I finally disconnected the call.

“Have you talked to anyone other than this - David?” Kerry asked.

“Well - um, no.”

Kerry brought up the Ambird Sweepstakes Company website on her phone. There it was in black and white:

Legitimate sweepstakes and promotions never ask winners to pay anything before receiving a prize, and taxes are always paid directly to the Internal Revenue Service (IRS) after receipt of winnings. If someone asks you to send money, pay fees or taxes to claim your prize, YOU ARE BEING SCAMMED.

Fraudsters illegally use our name and logo to deceive consumers with this kind of fraud every year. We are aware of our name being used for an international lottery scheme. If someone contacts you stating that you're a winner of such a promotion, IT IS A SCAM. DO NOT SEND MONEY.

***************

Ambird International Lottery does not exist. The fraudsters sent Ms. Johansan two bogus letters: the first stating she'd won the sweepstakes and the second from the “IRS.” The Internal Revenue Service does not send letters demanding payment to claim lottery winnings.

When David's attempts to get Ms. Johanson to pay to claim her fake lottery winnings fell through the cracks, he attempted to get her to take part in a money laundering scheme.

***************

Lottery scams have become more sophisticated over the years. Crooks may try to contact you via mail, e-mail, phone or social media claiming that you've won a lottery. They will state that you have to pay taxes or a fee to collect the winnings. Some scammers even use well-known companies and even pose as industry leaders to fool victims into sending them money. Protect yourself by following these tips:

- Ignore solicitations from companies claiming that you've won a prize in a sweepstake you've never entered.

- File a complaint with the Federal Trade Commission FTC and your attorney general's office.

- If you remember entering the sweepstake, confirm your prize by contacting the company at the number found on the website - not in the letter.

- If you received the prize notice via bulk rate postage, it might be a scam.

- Never give your personal financial information in exchange for lottery winnings.

- If the scam letter or communication arrived by mail or email, contact a postal inspector.

- Never take immediate action on a winning notification, even if there is a tight deadline. Scammers are counting on you to act quickly instead of checking things out.

If you've provided your account information to a suspected scammer, contact an F&A Federal Credit Union member representative to discuss steps to remedy the situation.

May I Ask Who's Calling?

Caller ID Spoofing Scam

My stomach tightened as I listened to the caller.

“Mrs. Rice, we'll need your username and a few other details,” he said. “The sooner we can confirm your information, the better. The longer you wait - well, let's just say - these criminals are good. Real good. They'll have your card maxed out before you know it.”

“What's your name again?” I could barely keep up with everything he'd said. All I knew was that he had me concerned. My best friend Jackie had her purse stolen last year, and it was a nightmare to get it all straightened out. Those crooks not only used every credit and debit card in her wallet but they tried to steal her identity too.

“It's Phil Smith with your credit union. You can check the caller ID on your phone and see the call is from Alpha Bird Credit Union.”

I looked at my phone again. Yes, he was right. The caller ID read “Alpha Bird Credit Union.” But something still felt off. Why was he asking for my private information? My Visa debit card wasn't stolen. It was in my wallet - at least it was the last time I checked.

“What do you need my information for? I haven't reported anything.”

Without missing a beat, Phil told me there had been some questionable activity on a few of the member debit card accounts, so they were randomly checking on other accounts to make sure their system was secure.

“We can also try your password challenge questions if you feel more comfortable with that,” he offered.

“Hmm, I don't know if I should do that,” I hesitated. “Can't I just come to the branch and talk to you there?”

“At Alpha Bird Credit Union, your account safety is our priority. We need your cooperation to keep your Visa card safe. That's what you want, isn't it?” When I didn't say anything, he continued. “This is for the card ending in 5307. You have a card ending in those numbers, don't you?”

I felt like I'd swallowed a marble.

I reached for my wallet. There it was. My card ending in 5307. A feeling of relief washed over me.

“Are you still there Mrs. Rice?”

“Yes, I'm here.”

“We don't have much time to protect your card. The sooner you can confirm your information, the quicker we can make sure it stays out of the hands of criminals.”

I didn't know what to say. I'd heard about scammers calling people pretending to be someone else, but this couldn't be the case. After all, the caller ID confirmed the call was from my credit union. Just something in Phil's voice made my blood run cold.

“Can I call you back?”

“Why? We need to take care of this now,” Phil pressed.

“I just need to check on something,” I said as I held my breath. “I'll call you back in a few minutes.”

“No! - Um, I mean - Mrs. Rice, we need to take action now. Your card is in jeopardy. If you don't give me the information now, we'll need to put a hold on your card, and you won't be able to use it.”

“I - I don't think so.” I hung up not knowing if I'd done the right thing.

***************

Mrs. Rice was correct in suspecting the caller. Phil was using fake caller ID information, aka “caller ID spoofing,” to fool Mrs. Rice into providing confidential information. This is a way for scammers to appear to represent a particular company or person. The caller's name, phone number or both can be spoofed, which can make it look like a legitimate call. Phil made it seem as if he was calling from her credit union by disguising his true identity.

While Phil did not have Mrs. Rice's physical Visa debit card, her card number had been stolen and he attempted to contact her to obtain more information. While Mrs. Rice's debit card was in her possession, the card number may have been stolen virtually via malware on her computer, a shimmer device at the gas pump or via a merchant data breach. The fraudster was now attempting to gain more information so he could access her financial accounts.

The next day, Mrs. Rice visited her credit union and found there was indeed fraud on her card. Her card number had been stolen, and the fraudster was contacting her to gain further access to her account information.

***************

Since relying on caller ID to verify a caller's identity can put you at risk, protect yourself by following these tips:

- Don't confirm or provide your personal or financial information to an unexpected caller regardless of what is displayed on your caller ID.

- Call the company's phone number directly or visit the location if there is a request for personal or financial information.

- If the caller expresses a sense of urgency in obtaining the information, hang up.

- Contact the company the caller was spoofing to report the incident.

- Report caller ID spoofing to the Federal Trade Commission and the Federal Communications Commission.

If an unexpected caller claims to represent F&A Federal Credit Union, please take these steps if the caller is requesting personal or account information:

- Record the person's name and phone number.

- Confirm the purpose of the request.

- Do not give out any personal or confidential information regardless of how time sensitive the caller makes it seem.

- End the call.

- Contact F&A Federal Credit Union at 800-222-1226 for immediate assistance.

Always trust your instincts.

If something doesn't feel right, it's probably not.

Actions for Fraud Victims

If you suspect fraud, it is important to act quickly to minimize potential damage and your own liability. It is important to keep a detailed account of conversations you have with authorities and financial institutions.

Credit Bureaus. Immediately call the fraud units of the three credit reporting companies -- Experian (formerly TRW), Equifax and Trans Union . Ask that your account include a statement referencing the possibility of fraud.

Creditors. Contact all creditors immediately with whom your name has been used fraudulently -- by phone and in writing. Monitor your accounts closely for any further fraudulent activity.

Law Enforcement. Report the crime to police with jurisdiction in your case. Provide any documentation that you have collected. Get a copy of your police report. Keep the phone number of your fraud investigator handy and give it to creditors and others who require verification of your case.

Financial Institutions. If you have checks stolen or bank accounts set up fraudulently, contact the institution to report the crime. Put stop payments on appropriate outstanding checks. Close your checking and savings accounts and open new accounts. If your ATM card is stolen or compromised, get a new card and PIN. When choosing a PIN, don't use common numbers like the last four digits of your Social Security number, your date of birth, license number or street address.

U.S. Postal Service. Notify the local Postal Inspector if you suspect an identity thief has filed a change of your address with the post office or has used the mail to commit credit or bank fraud.

Social Security Administration. Call to report fraudulent use of your Social Security number.

Department of Motor Vehicles (DMV). Call to see if another license was issued in your name. Go to your local DMV to request a new number. Also, fill out the DMV's complaint form to begin the fraud investigation process. Send supporting documents with the completed form to the nearest DMV investigation office. Request a driver's license number different than your Social Security number if available in your state.

Civil Courts. If a civil judgment has been entered in your name for actions taken by your impostor, contact the court where the judgment was entered and report that you are a victim of identity theft. If you are wrongfully prosecuted for criminal charges, contact the state Department of Justice and the FBI.

Para información en español, visite www.consumerfinance.gov/learnmore o escribe a la Consumer Financial Protection Bureau, 1700 G Street N.W., Washington, DC 20552.

You are receiving this information because you have notified a consumer reporting agency that you believe that you are a victim of identity theft. Identity theft occurs when someone uses your name, Social Security number, date of birth, or other identifying information, without authority, to commit fraud.

For example, someone may have committed identity theft by using your personal information to open a credit card account or get a loan in your name. For more information, visit www.consumerfinance.gov/learnmore or write to: Consumer Financial Protection Bureau, 1700 G Street N.W., Washington, DC 20552.

The Fair Credit Reporting Act (FCRA) gives you specific rights when you are, or believe that you are, the victim of identity theft. Here is a brief summary of the rights designed to help you recover from identity theft.

1. You have the right to ask that nationwide consumer reporting agencies place “fraud alerts” in your file to let potential creditors and others know that you may be a victim of identity theft.

A fraud alert can make it more difficult for someone to get credit in your name because it tells creditors to follow certain procedures to protect you. It also may delay your ability to obtain credit. You may place a fraud alert in your file by calling just one of the three nationwide consumer reporting agencies. As soon as that agency processes your fraud alert, it will notify the other two, which then also must place fraud alerts in your file.

- Equifax: 1-800-525-6285; www.equifax.com

- Experian: 1-888-397-3742; www.experian.com

- TransUnion: 1-800-680-7289; www.transunion.com

An initial fraud alert stays in your file for at least one year. An extended alert stays in your file for seven years. To place either of these alerts, a consumer reporting agency will require you to provide appropriate proof of your identity, which may include your Social Security number. If you ask for an extended alert, you will have to provide an identity theft report. An identity theft report includes a copy of a report you have filed with a federal, state, or local law enforcement agency, and additional information a consumer reporting agency may require you to submit. For more detailed information about the identity theft report, visit www.consumerfinance.gov/learnmore.

2. You have the right to free copies of the information in your file (your “file disclosure”). An initial fraud alert entitles you to a copy of all the information in your file at each of the three nationwide agencies, and an extended alert entitles you to two free file disclosures in a 12-month period following the placing of the alert. These additional disclosures may help you detect signs of fraud, for example, whether fraudulent accounts have been opened in your name or whether someone has reported a change in your address. Once a year, you also have the right to a free copy of the information in your file at any consumer reporting agency, if you believe it has inaccurate information due to fraud, such as identity theft. You also have the ability to obtain additional free file disclosures under other provisions of the FCRA. See www.consumerfinance.gov/learnmore.

3. You have the right to obtain documents relating to fraudulent transactions made or accounts opened using your personal information. A creditor or other business must give you copies of applications and other business records relating to transactions and accounts that resulted from the theft of your identity, if you ask for them in writing. A business may ask you for proof of your identity, a police report, and an affidavit before giving you the documents. It may also specify an address for you to send your request. Under certain circumstances a business can refuse to provide you with these documents. See www.consumerfinance.gov/learnmore.

4. You have the right to obtain information from a debt collector. If you ask, a debt collector must provide you with certain information about the debt you believe was incurred in your name by an identity thief - like the name of the creditor and the amount of the debt.

5. If you believe information in your file results from identity theft, you have the right to ask that a consumer reporting agency block that information from your file. An identity thief may run up bills in your name and not pay them. Information about the unpaid bills may appear on your consumer report. Should you decide to ask a consumer reporting agency to block the reporting of this information, you must identify the information to block, and provide the consumer reporting agency with proof of your identity and a copy of your identity theft report. The consumer reporting agency can refuse or cancel your request for a block if, for example, you don't provide the necessary documentation, or where the block results from an error or a material misrepresentation of fact made by you. If the agency declines or rescinds the block, it must notify you. Once a debt resulting from identity theft has been blocked, a person or business with notice of the block may not sell, transfer, or place the debt for collection.

6. You also may prevent businesses from reporting information about you to consumer reporting agencies if you believe the information is a result of identity theft. To do so, you must send your request to the address specified by the business that reports the information to the consumer reporting agency. The business will expect you to identify what information you do not want reported and to provide an identity theft report.

7. The following FCRA right applies with respect to nationwide consumer reporting agencies:

Consumers Have the Right to Obtain a Security Freeze

You have a right to place a “security freeze” on your credit report, which will prohibit a consumer reporting agency from releasing information in your credit report without your express authorization. The security freeze is designed to prevent credit, loans, and services from being approved in your name without your consent. However, you should be aware that using a security freeze to take control over who gets access to the personal and financial information in your credit report may delay, interfere with, or prohibit the timely approval of any subsequent request or application you make regarding a new loan, credit, mortgage, or any other account involving the extension of credit.

As an alternative to a security freeze, you have the right to place an initial or extended fraud alert on your credit file at no cost. An initial fraud alert is a 1-year alert that is placed on a consumer's credit file. Upon seeing a fraud alert display on a consumer's credit file, a business is required to take steps to verify the consumer's identity before extending new credit. If you are a victim of identity theft, you are entitled to an extended fraud alert, which is a fraud alert lasting 7 years.

A security freeze does not apply to a person or entity, or its affiliates, or collection agencies acting on behalf of the person or entity, with which you have an existing account that requests information in your credit report for the purposes of reviewing or collecting the account. Reviewing the account includes activities related to account maintenance, monitoring, credit line increases, and account upgrades and enhancements.

To learn more about identity theft and how to deal with its consequences, visit www.consumerfinance.gov/learnmore, or write to the Consumer Financial Protection Bureau.

You may have additional rights under state law. For more information, contact your local consumer protection agency or your state Attorney General.

In addition to the new rights and procedures to help consumers deal with the effects of identity theft, the FCRA has many other important consumer protections.

They are described in more detail at www.consumerfinance.gov/learnmore.

How to OPT-OUT of Credit Card Pre-Approvals

You can OPT OUT of credit card and other pre-approvals easily! When you do, you can choose to either opt out permanently or for five years.

You can either call 1-888-5-OPT-OUT or go to optoutprescreen.com .

It won't eliminate every pre-approval. Frequent flier cards and hotel points cards are not blocked, for example. But it will take care of most of the offers you would have received.

Fraud Awareness Resources

- onGuardOnline.gov

- OnGuardOnline.gov provides practical tips from the federal government and the technology industry to help you be on guard against Internet fraud, secure your computer, and protect your personal information.

- Federal Trade Commission

- Your National Resource for ID Theft information.

- Internet Safety

- For computer security and Internet safety.

- The Anti-Phishing Working Group

- Learn about phishing and pharming, and how to report suspicious emails.

- National Check Fraud Center

- A complete source for assistance, information, and alert reports concerning check fraud, counterfeit checks, forgery, bank fraud, white collar crimes, plus more.

- Identity Theft Resource Center

- An information resource for consumers and victims. Contains scam alerts, current laws, survey results, informational guides, and much more.

- Privacy Rights Clearinghouse

- ID Theft facts, helpful publications, victim stories, and informational links.

- U. S. Department of Justice

- The official ID Theft website of the U. S. Department of Justice.

- LooksTooGoodToBeTrue.com

- Learn about fraud.

Twelve common questions about consumer credit and direct marketing